Travel insurance typically covers pre-existing conditions if purchased within a specific timeframe after booking. Policies vary greatly, so it’s essential to read the terms carefully.

Travel insurance can be a crucial safety net for travelers, especially those with pre-existing medical conditions. Understanding how different policies handle these conditions helps ensure adequate coverage during trips. Pre-existing conditions refer to any health issues that existed before purchasing the insurance.

Some insurers offer full coverage, while others may impose exclusions or limitations. Travelers should compare plans, paying attention to the definitions and timeframes specified by each policy. Knowing the details can prevent unexpected medical costs abroad, allowing for a stress-free travel experience. Ensure you prioritize your health and financial security when selecting a travel insurance policy.

What Are Pre-existing Conditions?

Travel insurance helps protect you while you explore the world. Pre-existing conditions can affect your coverage. Understanding these conditions is vital for travelers. What are pre-existing conditions? They are medical issues present before purchasing travel insurance. Knowing this can save you from unexpected costs and headaches.

Common Examples

Pre-existing conditions vary widely. They can include chronic illnesses and past surgeries. Here are some common examples:

- Heart disease

- Diabetes

- Asthma

- High blood pressure

- Cancer

- Recent surgeries or treatments

Insurance companies may ask about your health history. They want to know if you have any of these conditions. It’s essential to be honest. Here’s a quick reference table of common conditions:

| Condition | Example |

|---|---|

| Heart Disease | Angina, Heart Attack |

| Respiratory Issues | Chronic Obstructive Pulmonary Disease (COPD) |

| Diabetes | Type 1 and Type 2 Diabetes |

| Cancer | Any type, treated or untreated |

Knowing these conditions helps you prepare. It also helps you choose the right insurance.

Insurance Implications

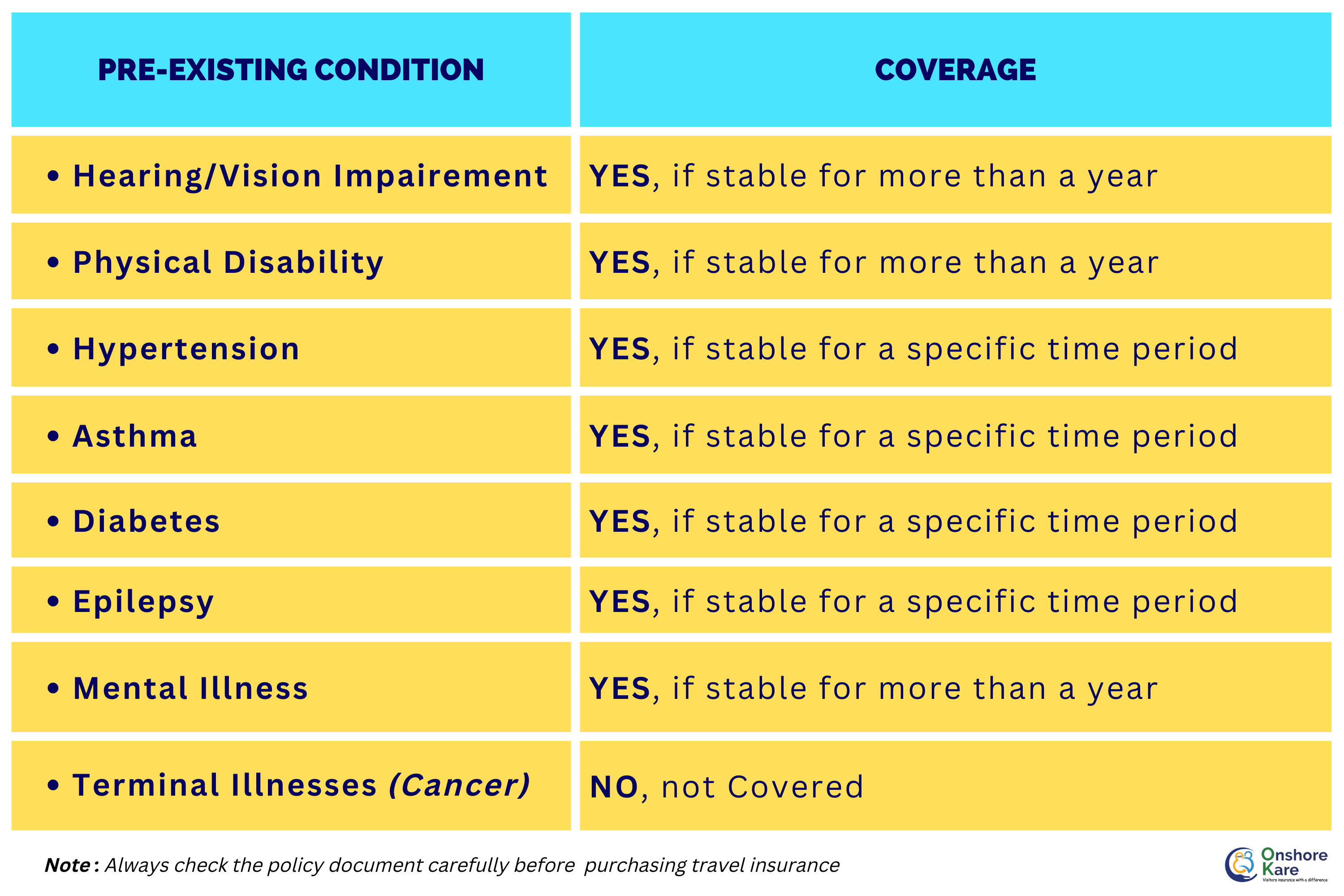

Pre-existing conditions can change your travel insurance options. Some policies may not cover these conditions at all. Others may offer limited coverage. Always check the fine print. Here are some key points:

- Many insurers have a waiting period.

- Some may require you to declare your condition.

- Coverage may depend on how stable your condition is.

- Insurance may cost more if you have a pre-existing condition.

- Research policies that cover pre-existing conditions.

- Compare different insurance providers.

- Ask questions about your specific health issues.

Understanding these implications is crucial. It ensures you have the right coverage for your trip.

Types Of Travel Insurance

Travel insurance is essential for safe journeys. It protects against unexpected events like accidents or illness. Understanding the types of travel insurance is crucial, especially for those with pre-existing conditions. Each plan offers different levels of coverage. Choosing the right one can save money and provide peace of mind.

Comprehensive Plans

Comprehensive plans offer extensive coverage for various travel issues. These plans usually include:

- Medical expenses: Covers hospital visits and emergency care.

- Trip cancellations: Reimburses costs if you cancel your trip.

- Lost baggage: Helps recover costs for lost or delayed luggage.

- Emergency evacuation: Provides transportation in case of medical emergencies.

Comprehensive plans are ideal for travelers with pre-existing conditions. They typically cover medical issues that arise during the trip. Some key features include:

| Feature | Description |

|---|---|

| Coverage for pre-existing conditions | Some plans cover specific pre-existing conditions after a waiting period. |

| Higher limits | Offers higher coverage limits for medical expenses. |

| 24/7 assistance | Provides round-the-clock support for emergencies. |

Comprehensive plans may cost more than basic coverage. They often provide better protection. Always read the policy details carefully.

Basic Coverage

Basic coverage provides essential protection for travelers. It focuses on the most common issues. This type of insurance generally includes:

- Emergency medical coverage: Covers urgent medical needs.

- Trip interruption: Reimburses for changes in travel plans.

- Accidental death: Provides benefits in case of a travel-related accident.

Basic coverage may not include coverage for pre-existing conditions. It’s usually cheaper than comprehensive plans. Here are some important points:

| Limitation | Description |

|---|---|

| No coverage for pre-existing conditions | Most basic plans do not cover existing health issues. |

| Lower coverage limits | Offers lower amounts for medical expenses. |

| Limited assistance | May not provide 24/7 support for emergencies. |

Basic coverage suits healthy travelers needing minimal protection. Always compare plans to ensure the right choice.

Coverage For Pre-existing Conditions

Travel insurance can protect you while exploring new places. One important aspect is coverage for pre-existing conditions. These are health issues you had before buying insurance. Knowing how different plans treat these conditions can help you make the best choice. Understanding coverage options and exclusions is vital for travelers with health concerns.

Full Coverage Options

Many travel insurance plans offer full coverage for pre-existing conditions. This can give you peace of mind while traveling. Here are some options to consider:

- Look-back period: Some insurers have a look-back period. This is the time they check your health history.

- Stability requirement: Many policies require your condition to be stable for a certain time.

- Medical evaluation: Some plans may ask for a doctor’s note to confirm stability.

It’s essential to compare policies to find the right fit. Here’s a simple table comparing coverage options:

| Insurance Provider | Look-back Period | Stability Requirement | Medical Evaluation |

|---|---|---|---|

| Provider A | 12 months | Stable for 6 months | Required |

| Provider B | 24 months | Stable for 12 months | Not Required |

| Provider C | 6 months | Stable for 3 months | Required |

Review your options carefully. Full coverage can save you from high medical costs abroad.

Exclusion Clauses

Exclusion clauses are common in travel insurance. These clauses define what is not covered. Understanding these can help you avoid surprises. Here are some typical exclusions:

- Unstable conditions: If your condition worsens before travel, it may not be covered.

- Non-disclosure: Not informing the insurer about your condition can lead to denial of claims.

- Specific conditions: Some plans exclude certain pre-existing conditions entirely.

Read the policy carefully. Check for specific exclusion clauses. Here’s a short list of common exclusions:

- Heart conditions

- Diabetes complications

- Cancer treatments

Understanding these exclusions is crucial. It helps ensure you have the coverage you need while traveling.

Travel Insurance Providers

Travel insurance helps protect you while you explore the world. Many people have pre-existing medical conditions that can complicate travel insurance. Comparing travel insurance providers is crucial. Some companies cover pre-existing conditions better than others. Understanding the options will help you choose wisely.

Major Companies

Several major travel insurance companies offer plans that cover pre-existing conditions. These companies have a broad reach and solid reputations. They often provide various options for travelers with medical issues. Here are some key players:

- Allianz Global Assistance – Known for comprehensive coverage and 24/7 support.

- Travel Guard – Offers customizable plans, including options for pre-existing conditions.

- AXA Assistance USA – Provides extensive coverage and a user-friendly claims process.

- World Nomads – Perfect for adventurous travelers, covering a wide range of activities.

Here’s a quick comparison table of these major companies:

| Company | Coverage for Pre-existing Conditions | Customer Support |

|---|---|---|

| Allianz Global Assistance | Yes, with conditions | 24/7 availability |

| Travel Guard | Yes, customizable | Online and phone |

| AXA Assistance USA | Yes, with certain limits | 24/7 availability |

| World Nomads | Yes, for specific activities | Online only |

Choosing a major provider can offer peace of mind. These companies have established networks and resources.

Niche Providers

Niche travel insurance providers focus on specific needs. They can offer tailored coverage for pre-existing conditions. These companies often cater to unique traveler profiles.

- InsureMyTrip – A marketplace that compares various plans from different providers.

- Travelex Insurance Services – Offers specialized plans for families and seniors.

- MedjetAssist – Focuses on emergency medical transport and evacuation.

- IMG – Provides international travel insurance with options for pre-existing conditions.

Here’s a comparison table of niche providers:

| Provider | Specialty | Pre-existing Condition Coverage |

|---|---|---|

| InsureMyTrip | Insurance comparison | Varies by plan |

| Travelex | Family and senior plans | Yes, with conditions |

| MedjetAssist | Medical transport | Limited coverage |

| IMG | International travel | Yes, with limits |

Niche providers can meet specific needs. They may offer better options for travelers with unique situations.

Policy Comparisons

Choosing the right travel insurance is crucial, especially when dealing with pre-existing conditions. Policy comparisons help you understand the different options available in the market. Comparing policies allows you to find the best balance between cost and coverage. Travelers need to ensure they are protected against unexpected medical expenses while traveling.

Cost Vs. Coverage

Finding the right balance between cost and coverage is essential for your travel insurance. A cheap policy may not offer enough coverage for your needs. Here are some key points to consider:

- Premium Costs: Monthly fees can vary widely between providers.

- Deductibles: The amount you pay before insurance kicks in.

- Coverage Limits: Maximum payout for medical expenses.

Look at this table for a clear comparison:

| Provider | Monthly Cost | Coverage Limit | Deductible |

|---|---|---|---|

| Provider A | $50 | $100,000 | $500 |

| Provider B | $40 | $75,000 | $300 |

| Provider C | $60 | $150,000 | $700 |

Coverage types matter too. Here are some common options:

- Emergency medical coverage

- Trip cancellation insurance

- Evacuation coverage

Always read the fine print. Understand what is included and excluded in each policy.

Customer Reviews

Customer reviews provide valuable insights into travel insurance policies. They highlight real experiences from travelers. Positive reviews can indicate reliability and good customer service.

Consider these points while reading reviews:

- Claims Process: Was it smooth and hassle-free?

- Customer Support: Were representatives helpful and responsive?

- Value for Money: Did customers feel their policy was worth it?

Here’s a summary of reviews from different providers:

| Provider | Rating (out of 5) | Comments |

|---|---|---|

| Provider A | 4.5 | Quick claims and great service. |

| Provider B | 3.8 | Good coverage but slow response. |

| Provider C | 4.9 | Excellent support and easy claims. |

Read multiple reviews for a balanced view. Look for patterns in feedback to gauge overall satisfaction.

Steps To Get Coverage

Traveling is exciting, but it can come with risks, especially if you have pre-existing conditions. Getting the right travel insurance is vital. Steps to get coverage help you find the best plan for your needs. Follow these steps to ensure you are protected during your travels.

Evaluating Needs

Before buying travel insurance, evaluate your needs. Consider these factors:

- Your health condition: List all pre-existing conditions.

- Medical history: Note past treatments and medications.

- Travel plans: Include destinations and activities.

- Duration of travel: Longer trips may need more coverage.

Next, create a table to compare the coverage options:

| Insurance Provider | Coverage for Pre-Existing Conditions | Cost |

|---|---|---|

| Provider A | Yes, with conditions | $150 |

| Provider B | No | $120 |

| Provider C | Yes, full coverage | $200 |

Understanding your needs helps you choose the right plan. Always read the fine print. Check what is covered and what is not. Knowing this ensures you won’t face surprises later.

Getting Quotes

After evaluating your needs, the next step is getting quotes. Start by researching different insurance providers. Here’s how to do it:

- Visit websites: Look for travel insurance companies.

- Fill out a form: Provide details about your trip and health conditions.

- Compare offers: Gather several quotes for comparison.

Use the following tips to get the best quotes:

- Check for discounts.

- Look for plans that cover pre-existing conditions.

- Ask about additional fees.

Once you gather quotes, compare them side by side. Focus on coverage limits and exclusions. Choose a plan that offers peace of mind while you travel.

Claim Process Explained

Understanding the claim process for travel insurance with pre-existing conditions is essential. Many travelers worry about how their health issues affect claims. Knowing the steps can help you navigate claims smoothly. This section will break down what you need and the challenges you might face.

Documentation Required

Gathering the right documentation is crucial for a successful claim. Insurers require specific documents to process your claim. Here are the essential items you should prepare:

- Claim Form: Complete the insurance company’s claim form accurately.

- Medical Records: Include detailed medical records related to your pre-existing condition.

- Doctor’s Notes: Obtain notes from your healthcare provider that explain your condition.

- Receipts: Keep all receipts for any medical expenses incurred during your trip.

- Proof of Travel: Provide a copy of your travel itinerary and tickets.

Here’s a quick table summarizing the documentation:

| Document | Description |

|---|---|

| Claim Form | Official form filled out by the claimant. |

| Medical Records | Detailed history of your pre-existing condition. |

| Doctor’s Notes | Professional insights into your health status. |

| Receipts | Proof of medical expenses during travel. |

| Proof of Travel | Itinerary and tickets showing your travel dates. |

Having all this documentation ready can speed up the process. Ensure everything is clear and organized. Missing documents can delay your claim.

Common Challenges

The claim process can be tricky. Many travelers face common challenges that can complicate things. Here are some frequent issues:

- Incomplete Documentation: Missing papers can lead to claim denial.

- Policy Exclusions: Some policies exclude certain pre-existing conditions.

- Understanding Terms: Insurance jargon can confuse many people.

- Time Limits: Claims must be filed within a specific time frame.

Here are some tips to overcome these challenges:

- Read your policy carefully before travel.

- Contact your insurer for clarification on terms.

- Keep copies of all submitted documents.

- Submit your claim as soon as possible.

Being aware of these challenges can help you prepare. Stay organized and informed. This proactive approach makes the claim process easier.

Tips For Travelers

Traveling is exciting, but it can be tricky if you have pre-existing conditions. Comparing travel insurance options is essential. Understanding the details helps protect your health while you explore. Here are some tips for travelers to ensure you get the best coverage.

Reading Policy Details

Reading the fine print of your travel insurance policy is crucial. Many travelers skip this step and miss important information. Here’s what to look for:

- Coverage Limits: Check how much the insurance covers for medical expenses.

- Exclusions: Look for any conditions that are not covered.

- Waiting Periods: Some policies may have waiting periods for pre-existing conditions.

- Emergency Services: Know what emergency services are included.

Consider creating a table to compare key details from different policies:

| Insurance Company | Coverage Limit | Exclusions | Waiting Period |

|---|---|---|---|

| Company A | $100,000 | Heart issues | 30 days |

| Company B | $150,000 | Diabetes | No waiting |

| Company C | $200,000 | None | 15 days |

Highlight important sections in your policy. This helps during emergencies. Take notes on key points to remember.

Asking The Right Questions

Asking the right questions before buying travel insurance can save you stress. Here are some essential questions to consider:

- What conditions are covered? Ensure your pre-existing condition is included.

- Are there any exclusions? Know what the policy does not cover.

- What is the claims process? Understand how to file a claim if needed.

- Is there a helpline? Check if you can get help while traveling.

Here are some example questions to ask your insurance provider:

- Can I get coverage for my pre-existing condition?

- What documentation do I need?

- How long does it take to process a claim?

Write down answers from different companies. This helps you compare and choose wisely. Always clarify anything confusing. Your health is worth it!

Conclusion

Understanding travel insurance for pre-existing conditions is essential for a worry-free trip. Comparing different policies can help you find the best coverage for your needs. Always read the fine print and ask questions. Making informed choices ensures you travel with peace of mind, knowing you’re protected against unexpected events.

AWE Credits Free VISA Consultancy Service in USA, UK, UAE, CANADA, Australia

AWE Credits Free VISA Consultancy Service in USA, UK, UAE, CANADA, Australia