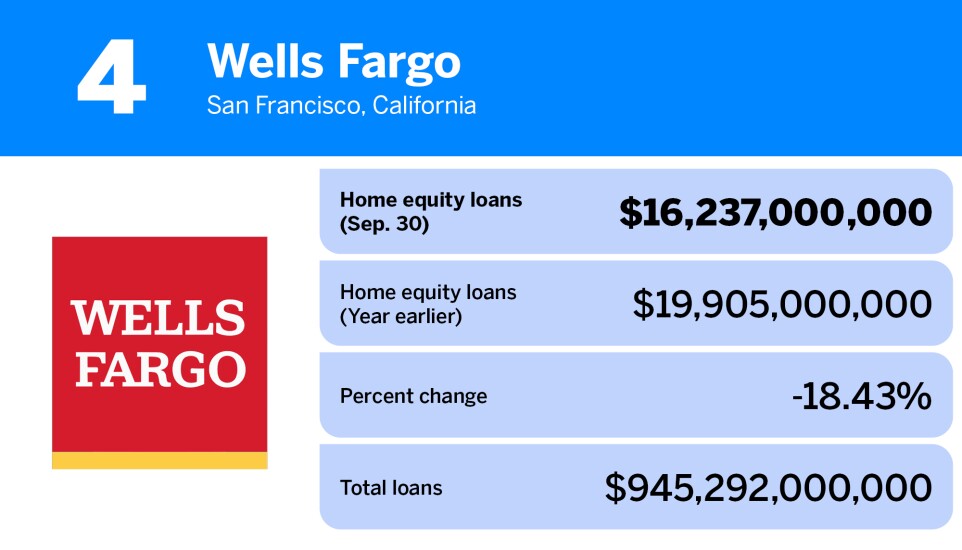

Wells Fargo offers a Home Equity Line of Credit (HELOC) that allows homeowners to borrow against their property’s equity. This flexible financing option can be used for various purposes, such as home improvements or debt consolidation.

Wells Fargo’s Home Equity Line of Credit is designed for homeowners seeking financial flexibility. It allows you to access funds as needed, making it suitable for projects like renovations or unexpected expenses. Borrowers can typically draw money during a draw period, which is often followed by a repayment phase.

Interest rates can be variable, impacting monthly payments. Understanding the terms, fees, and repayment options is crucial for making informed decisions. This line of credit can empower homeowners to take control of their finances while leveraging their property’s value.

Wells Fargo Heloc Basics

The Wells Fargo Home Equity Line of Credit (HELOC) is a smart way to use your home’s value. This guide covers the Wells Fargo HELOC Basics. Understanding a HELOC helps you make informed financial choices. It’s an important tool for homeowners looking to access cash.

What Is A Heloc?

A Home Equity Line of Credit (HELOC) is a loan that lets you borrow against the equity in your home. Equity is the difference between what your home is worth and what you owe on your mortgage. With a HELOC, you can access funds as needed, much like a credit card. Here are some key features:

- Flexible Borrowing: Withdraw only what you need.

- Variable Interest Rates: Rates may change over time.

- Draw Period: Usually lasts 5 to 10 years.

- Repayment Period: Followed by a repayment phase.

Here’s a simple table to illustrate how a HELOC works:

| Feature | Description |

|---|---|

| Equity | Amount of your home you own. |

| Credit Limit | Maximum amount you can borrow. |

| Interest Rate | Variable rates based on market. |

HELOCs are great for big expenses like home repairs, education, or debt consolidation. Use it wisely to improve your financial health.

How It Works

The Wells Fargo HELOC functions through a simple process. First, you apply for the line of credit. Wells Fargo evaluates your home’s value and your credit score. This determines your credit limit. Here’s how the process unfolds:

- Submit an application online or at a branch.

- Wells Fargo will assess your property and credit.

- Receive your credit limit offer.

- Access funds through checks, online transfers, or a debit card.

You can borrow during the draw period. During this time, you pay only interest on what you use. After that, the repayment period begins. You’ll pay both principal and interest. Here are some benefits:

- Access to cash as needed.

- Lower interest rates compared to personal loans.

- Tax deductions on interest in some cases.

Understanding how a HELOC works helps you manage your finances better. It’s a flexible option for homeowners needing funds.

Application Process

The Wells Fargo Home Equity Line of Credit (HELOC) offers a flexible way to access funds using your home’s equity. The application process is straightforward, but understanding the steps helps. Knowing the eligibility criteria and required documentation can save time and effort. Let’s dive into what you need to know.

Eligibility Criteria

To qualify for a Wells Fargo Home Equity Line of Credit, you must meet certain eligibility criteria. These criteria ensure that borrowers can repay their loans. Here are some key points:

- Home Equity: You must have enough equity in your home. This means your home’s value must be greater than the amount you owe.

- Credit Score: A good credit score is essential. Generally, a score of 620 or higher is preferred.

- Income Verification: You need a steady source of income. This helps show you can make payments.

- Debt-to-Income Ratio: Your monthly debts should not exceed a certain percentage of your income. Most lenders prefer a ratio below 43%.

Here’s a quick table summarizing the main eligibility criteria:

| Criteria | Details |

|---|---|

| Home Equity | Must have sufficient equity in the home. |

| Credit Score | Typically 620 or higher. |

| Income Verification | Steady income source required. |

| Debt-to-Income Ratio | Preferred ratio below 43%. |

Meeting these criteria can help you qualify for the HELOC. Always check with Wells Fargo for any specific conditions they might have.

Required Documentation

To apply for a Wells Fargo Home Equity Line of Credit, you need to provide certain documentation. Having these documents ready can speed up your application. Here’s what you need:

- Proof of Identity: A government-issued ID like a driver’s license or passport.

- Proof of Income: Pay stubs, W-2 forms, or tax returns are necessary.

- Property Information: Documents that show your home’s value, like an appraisal or tax statement.

- Existing Mortgage Statements: If you have a mortgage, provide recent statements.

Here’s a simple list of required documents:

- Proof of Identity

- Proof of Income

- Property Information

- Existing Mortgage Statements

Having these documents ready makes the application smoother. Contact Wells Fargo for any specific requirements or updates on their application process.

Interest Rates

The Wells Fargo Home Equity Line of Credit (HELOC) offers a flexible way to access funds. Interest rates play a crucial role in determining how much you will pay over time. Understanding these rates helps you make informed decisions about borrowing against your home equity.

Variable Vs Fixed Rates

Choosing between variable and fixed rates is essential. Both options have unique features and benefits. Here’s a quick breakdown:

- Variable Rates: These rates can change over time. They usually start lower than fixed rates. Your payments might go up or down.

- Fixed Rates: These rates remain the same throughout the loan term. Your monthly payments stay predictable, making budgeting easier.

Here’s a comparison table for quick reference:

| Feature | Variable Rate | Fixed Rate |

|---|---|---|

| Starting Rate | Usually lower | Stable |

| Payment Stability | Fluctuates | Consistent |

| Risk | Higher risk | Lower risk |

Consider your financial situation before deciding. Variable rates can save you money initially, but fixed rates offer security. Choose what fits your needs best.

Current Rate Trends

Current trends in interest rates affect your borrowing costs. Rates can change based on economic conditions. Staying updated helps you make smart choices.

As of now, interest rates are rising. This is due to inflation and changes in the economy. Here are some key points to note:

- Rates have increased over the last year.

- The Federal Reserve plays a significant role in these changes.

- Home equity borrowing costs may rise further.

Check the latest data to stay informed:

| Month | Average HELOC Rate |

|---|---|

| January 2023 | 5.25% |

| February 2023 | 5.50% |

| March 2023 | 5.75% |

Watch for future changes. Understanding current rate trends can guide your decisions about a Wells Fargo HELOC.

Benefits Of Heloc

Wells Fargo Home Equity Line of Credit (HELOC) offers many benefits for homeowners. A HELOC lets you borrow money using your home as collateral. It gives you access to funds whenever you need them. This can be very useful for big expenses, like home renovations or education costs. Understanding the benefits of a HELOC helps you make smart financial choices.

Flexibility In Borrowing

One major advantage of a Wells Fargo HELOC is its flexibility in borrowing. You can withdraw funds as needed, unlike a traditional loan where you get a lump sum. This makes it easier to manage your expenses over time. Here are some key points about this flexibility:

- Draw Period: You can borrow during a set time, often 5 to 10 years.

- Revolving Credit: Borrow, repay, and borrow again without reapplying.

- Choose Your Amount: Withdraw any amount within your credit limit.

This flexibility allows you to control your finances better. For example, you can use a HELOC for:

- Home improvements

- Debt consolidation

- Unexpected medical bills

Here’s a simple table showing how a HELOC compares to a traditional loan:

| Feature | HELOC | Traditional Loan |

|---|---|---|

| Funds Access | Flexible and ongoing | One-time payment |

| Repayment Structure | Revolving credit | Fixed payments |

| Interest Rates | Variable rates | Fixed rates |

This table shows how a HELOC can fit your financial needs. The ability to borrow only what you need makes a HELOC a smart choice.

Potential Tax Deductions

A Wells Fargo HELOC can offer potential tax deductions. Interest on a home equity line of credit may be tax-deductible. This can save you money on your yearly tax bill. Here are the key points:

- Home Improvements: If you use funds for home improvements, the interest may be deductible.

- Qualified Expenses: Make sure your expenses qualify under tax laws.

- Tax Consultation: Always consult a tax professional for advice.

Here’s a simple breakdown of how tax deductions work with a HELOC:

| Expense Type | Deductible? |

|---|---|

| Home renovation | Yes |

| Debt consolidation | No |

| Personal expenses | No |

Understanding tax deductions can help you maximize savings. A HELOC not only provides access to funds but can also lead to financial benefits at tax time. Make sure to keep good records of your spending.

Risks Involved

The Wells Fargo Home Equity Line of Credit (HELOC) can be a powerful tool for homeowners. It allows access to funds based on home equity. While it offers benefits, there are also notable risks involved. Understanding these risks can help you make informed decisions. Let’s explore two significant risks: market fluctuations and impact on credit score.

Market Fluctuations

Market fluctuations can greatly affect the value of your home. If property values drop, your equity may decrease. This can impact your ability to borrow. Here are some key points to consider:

- Home Value Decline: A decrease in home prices reduces your equity.

- Loan-to-Value Ratio: A higher ratio can lead to borrowing limits.

- Potential Foreclosure: Falling values can lead to financial strain.

Understanding how market changes impact your finances is crucial. Here’s a brief table showing potential scenarios:

| Scenario | Home Value | Equity Available |

|---|---|---|

| Initial | $300,000 | $100,000 |

| Value Drops | $250,000 | $50,000 |

| Value Increases | $350,000 | $150,000 |

Be aware of how the market can shift. Home values can change quickly, affecting your financial plans.

Impact On Credit Score

Your credit score can be affected by using a HELOC. Borrowing too much can lower your score. Here are some factors to keep in mind:

- Credit Utilization: High usage of your available credit can decrease your score.

- Missed Payments: Late payments can significantly harm your credit rating.

- New Credit Inquiries: Applying for a HELOC can result in hard inquiries.

Understanding how your credit score works is essential. Here’s a simple breakdown:

| Credit Score Factor | Impact |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Length of Credit History | 15% |

| Types of Credit | 10% |

| New Credit | 10% |

Keep your credit score healthy by managing your HELOC wisely. Always make timely payments and monitor your credit utilization.

Repayment Options

Wells Fargo Home Equity Line of Credit (HELOC) offers flexible repayment options. Understanding how these options work can help you manage your finances better. Whether you’re renovating your home or covering unexpected expenses, knowing the repayment details is crucial.

Draw Period Vs Repayment Period

The repayment process for a Wells Fargo HELOC has two main phases: the draw period and the repayment period. During the draw period, you can borrow from your line of credit. This phase typically lasts for 5 to 10 years. You only pay interest on the amount you borrow. Your payments during this phase are usually lower.

Once the draw period ends, the repayment period begins. This lasts for 10 to 20 years. You can no longer borrow money during this phase. Instead, you start paying back the principal and interest. Here’s a quick comparison:

| Feature | Draw Period | Repayment Period |

|---|---|---|

| Duration | 5 to 10 years | 10 to 20 years |

| Borrowing | Allowed | Not allowed |

| Payment Type | Interest only | Principal + Interest |

It’s important to plan for the repayment period. Payments will increase since you will pay back both principal and interest. Ensure you budget accordingly to avoid financial strain.

Monthly Payment Calculations

Calculating your monthly payments for a Wells Fargo HELOC is straightforward. During the draw period, your payments depend on the interest rate and the amount borrowed. You can calculate your interest payment using this formula:

Interest Payment = (Loan Amount x Interest Rate) / 12

For example, if you borrow $10,000 at a 5% interest rate, your monthly interest payment would be:

Interest Payment = ($10,000 x 0.05) / 12 = $41.67

During the repayment period, your payments will change. You will pay back both principal and interest. You can use an online calculator or the following formula:

Monthly Payment = (Loan Amount x Monthly Interest Rate) / (1 - (1 + Monthly Interest Rate)^-Total Payments)

Consider this example:

- Loan Amount: $10,000

- Interest Rate: 5%

- Term: 15 years (180 months)

Plugging these numbers into the formula helps you find your monthly payment. Adjusting your budget for these payments is essential.

Understanding these calculations helps you prepare for the future. Knowing what to expect can ease financial worries.

Comparing Alternatives

The Wells Fargo Home Equity Line of Credit offers homeowners a way to access cash based on their home’s value. Understanding alternatives is essential for making the best choice. Many people consider options like home equity loans and personal loans. Each option has unique benefits and drawbacks.

Home Equity Loans

A home equity loan lets you borrow against your home’s value. It provides a lump sum of cash, which you repay over time. This option is great for large expenses like home renovations or debt consolidation.

Here are some key features:

- Fixed interest rates offer stability.

- Repayment terms typically range from 5 to 30 years.

- Interest may be tax-deductible.

Consider the following table comparing home equity loans and Wells Fargo’s HELOC:

| Feature | Home Equity Loan | Wells Fargo HELOC |

|---|---|---|

| Loan Type | Lump sum | Revolving credit |

| Interest Rate | Fixed | Variable |

| Repayment | Monthly payments | Minimum monthly payment |

Home equity loans suit those who need a set amount of money at a fixed rate. They provide predictability in payments. However, they require you to pay interest on the entire loan amount immediately.

Personal Loans

A personal loan is an unsecured loan that does not require home equity. You can use it for various purposes, like medical bills or vacations. Personal loans often have shorter terms than home equity loans.

Here are some advantages:

- No collateral required.

- Quick approval and funding.

- Flexible use of funds.

Consider the following comparison with Wells Fargo HELOC:

| Feature | Personal Loan | Wells Fargo HELOC |

|---|---|---|

| Collateral | None | Your home |

| Interest Rate | Fixed or variable | Variable |

| Loan Amount | Up to $50,000 | Based on home equity |

Personal loans work well for those who want funds quickly without risking their home. They may have higher interest rates than home equity loans. Evaluate your needs to determine the best option.

Customer Experiences

The Wells Fargo Home Equity Line of Credit (HELOC) offers flexible borrowing options. Many customers share their experiences with this financial product. Understanding these experiences helps potential borrowers make informed decisions. User reviews highlight both satisfaction and challenges. Common issues also appear in customer feedback.

User Reviews

Customer reviews of the Wells Fargo Home Equity Line of Credit reveal diverse opinions. Many users appreciate the ease of accessing funds. Here are some common praises:

- Quick Approval Process: Customers often mention fast approvals.

- Flexible Access: Borrowers enjoy the ability to draw funds as needed.

- Helpful Customer Service: Many users find the staff friendly and knowledgeable.

Some users, however, express concerns. These include:

- High Fees: Some customers feel fees are higher than expected.

- Interest Rates: A few users mention rising rates over time.

- Complicated Terms: Some find the terms hard to understand.

Here’s a summary of user ratings:

| Rating | Percentage of Users |

|---|---|

| 5 Stars | 45% |

| 4 Stars | 30% |

| 3 Stars | 15% |

| 2 Stars | 5% |

| 1 Star | 5% |

Overall, many customers have a positive experience. They appreciate the benefits of the HELOC.

Common Issues

Despite the positive reviews, some common issues arise with Wells Fargo’s HELOC. Understanding these can help future borrowers navigate challenges. Here are frequent concerns:

- Delayed Funding: Some users report waiting longer than expected for funds.

- Customer Service Response: A few customers mention slow responses during inquiries.

- Paperwork Complexity: Many find the paperwork confusing and overwhelming.

Here’s a list of specific complaints:

- Difficulty in understanding terms and conditions.

- Unclear explanations of fees associated with the HELOC.

- Unexpected changes in interest rates.

Addressing these common issues is essential. Customers are encouraged to read all terms carefully. Clear communication with Wells Fargo staff can also help resolve concerns.

Conclusion

Wells Fargo Home Equity Lines of Credit offer flexibility and financial options for homeowners. With competitive rates and user-friendly features, they can help you manage expenses or fund projects. Understanding the terms and conditions is crucial. Explore your options and see how this financial tool can benefit your unique situation.

AWE Credits Free VISA Consultancy Service in USA, UK, UAE, CANADA, Australia

AWE Credits Free VISA Consultancy Service in USA, UK, UAE, CANADA, Australia